Friday, February fourteenth, the UN says at least 22 people have been killed in a village in the Northwest region of Cameroon. Over half of those killed were children. No one has claimed responsibility for Friday’s incident but the opposition parties blame the killing on the government.

Impact of China's flat demand on oil prices

- Get link

- Other Apps

As the Brent front-month futures

contract stabilizes either side of the $40 per barrel level, and WTI lurks

within that range too, a comment by the International Energy Agency that the

“oil price may have bottomed out” has triggered a lot of market interest.

In its monthly oil forecast for

March, the IEA, which advises on energy policy matters of industrialized

nations, noted that non-OPEC oil production would fall by 750,000 barrels per

day (bpd) in 2016, compared with its previous estimate of 600,000 bpd

Specifically, US production is

forecast to decline by 530,000 bpd this year. OPEC’s crude oil production

eased by 90,000 bpd in February to 32.61 million bpd as losses from Iraq,

Nigeria and the United Arab Emirates partly offset a rise in flows from

post-sanctions Iran.

“Furthermore, Iran’s return to the market has

been less dramatic than the Iranians said it would be; in February we believe

that production increased by 220,000 bpd and provisionally, it appears that

Iran’s return will be gradual,” the IEA added.

Saudi Arabia, OPEC’s largest

producer, held supplies steady last month. It led the agency to opine: “There

are clear signs that market forces are working their magic and higher-cost

producers are cutting output.”

“For oil prices, there may be light

at the end of what has been a long, dark tunnel, but we cannot be precisely

sure when in 2017 the oil market will achieve the much-desired balance. It is

clear that the current direction of travel is the correct one, although with a

long way to go.”

The agency’s headline take attracted

a lot of attention, but hidden in plain sight were key observations –

particularly on China’s demand – that merit a pause for thought. The IEA

predicts demand in China to grow by 330,000 bpd this year, considerably below

the 10-year average of 440,000 bpd.

Although the dip would be coming

from a relatively high base – i.e. a near five-year high achieved during the

second quarter of 2015 when Beijing decided to increase stockpiling of crude

oil – it is nonetheless worrying, especially as the IEA warned that “risks to

global oil demand growth are almost certainly on the downside.”

In terms of forward pricing, China’s

oil demand growth, according to the agency’s own data, has accounted for an

average of 35% of global oil demand growth since 2000. Of course, the trend is

expected to continue with China making up more than a third of world oil demand

growth to 2035.

- Get link

- Other Apps

Popular posts from this blog

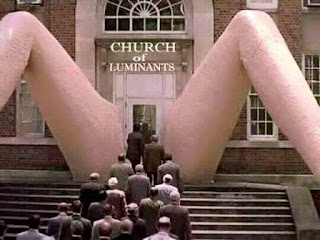

Entrance design of "Church Of Luminants" in USA

UN says at least 22 people including children killed in Cameroon's English-speaking region

Cameroon automobile industry company S.A. (CAIS) received 15 hectares of land for its car project

The planned construction and vehicle assembly in Cameroon is gradually being realised. The Cameroon automobile industry company S.A. (CAIS), Indo-chinese group bearer of this project formally got this Thursday, March 10, 15 hectares of land, granted by the Mission of development and planning of industrial zones (MAGZI). The ceremony was held there in Yaounde by the Minister of Mines, Industry and Technological Development Ernest Ngoua Boubou, in the presence of the Director General of MAGZI, Christol Georges Manon, and representatives of the CAIS group. Following the lifting of the main constraint for the project, the Indo-chinese group announced the laying of the foundation stone which will take place by June 2016. CAIS will implement its plants in two cities: Douala and Kribi. The project aims, according to its developers, to create more than 4,000 direct jobs.

Comments

Post a Comment