Friday, February fourteenth, the UN says at least 22 people have been killed in a village in the Northwest region of Cameroon. Over half of those killed were children. No one has claimed responsibility for Friday’s incident but the opposition parties blame the killing on the government.

Curruption disease in the oil and gas industry

- Get link

- Other Apps

A major bombshell broken by the Guardian newspaper this week, shows that something may have been amiss with a 2009 ExxonMobil oil bid in Nigeria — where the major won a massive concession, despite bidding $2.25 billion less than China’s CNOOC.

And the news on corruption in the resources sector didn’t

stop there. Reports also surfaced that the FBI may get involved in a widening probe into alleged bribery by Sable

Mining on iron ore projects in Liberia.

With all that going on, the U.S. Securities and Exchange

Commission (SEC) took the opportunity Monday to unveil some critical new rules

on oil and gas reporting. With the regulators bringing in strict requirements on how companies

working internationally report payments to governments.

Under the new rules, companies involved in oil and gas

extraction would have to disclose any payments over $100,000 made to state

bodies. With this information being made available to the public each year, as

part of a Form SD — or Specialized Disclosure report.

The move from the SEC is the latest in a long saga

related to payment disclosure for oil and gas. With such measures having

initially been mandated by the U.S. government as part of the Dodd-Frank Act of

2010.

The SEC subsequently proposed a first attempt at these

rules, but the measure was suspended by a Washington D.C. judge in 2013 — after

a lawsuit led by the American Petroleum Institute claimed that public

disclosure of payment information could put U.S. firms at a business disadvantage.

In 2014, Oxfam America then sued the SEC — to speed up a

second attempt at the payment rules. With this week’s announcement coming on

the last possible day that judges in that case allowed for the regulator to

present a re-written policy.

In regards to proprietary information, the SEC said that

oil and gas companies will still have to file all payments made during the

year. But the regulator will then translate that information into a “public

compilation” — presumably with the aim of protecting sensitive data.

Watch to see if that’s enough to satisfy oil and gas

industry groups — or if more lawsuits will be coming here.

Popular posts from this blog

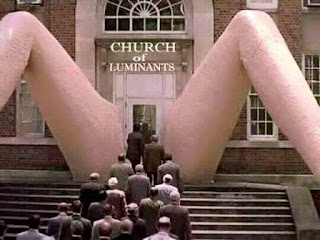

Entrance design of "Church Of Luminants" in USA

UN says at least 22 people including children killed in Cameroon's English-speaking region

Cameroonian scammer arrested in Montreal (canada

The Sûreté du Québec announced Wednesday the arrest of an alleged fraudster specialist of a scenario called "Black money scam", in which victims are invited to participate in the cleaning of soiled banknotes, then are robbed during the operation. Cyrille Ngogang, 49 years old, was caught red-handed in downtown Montreal Tuesday afternoon. He appeared in court this morning to be charged with fraud and breach of commitment. The man is not in his first trouble with the law: he was previously arrested by the SQ on 19 January for charges related to the same scheme, and had been able to resume its freedom under strict conditions pending his trial. There are several variants of the 'Black money' scenario, but all involve a so-called batch of cash that has been stained with a dye or colouring substance. Scammers ask their victim to provide money to clean the hoard.

Comments

Post a Comment